4.4 Banking and the Expansion of the Money Supply

5 min read•september 23, 2020

J

Jeanne Stansak

J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

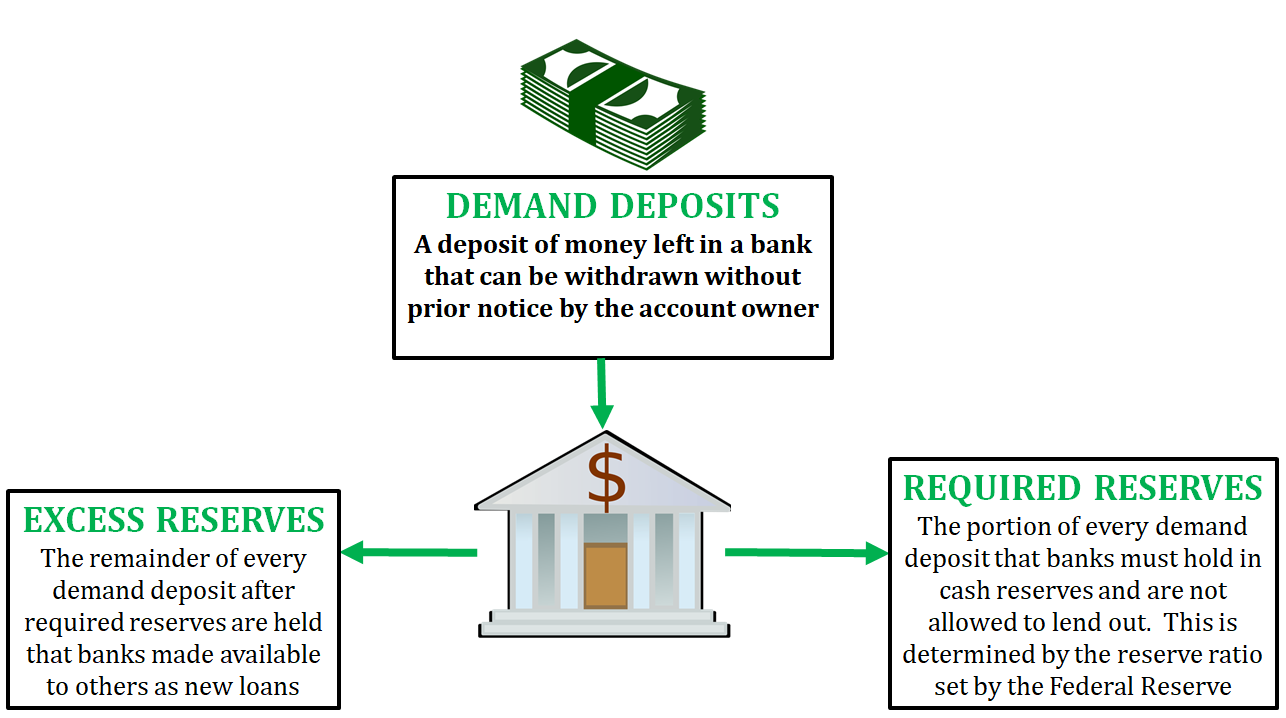

Banks are financial institutions that accept deposits and make loans. They also serve as intermediary bodies that help the Federal Reserve control the money supply. In our banks, we use a system known as fractional reserve banking.

Fractional Reserve Banking

Fractional Reserve Banking is the practice by which a bank accepts deposits and is required to hold only a fraction of its deposits in cash reserves. The amount that the bank has to keep as cash reserves is determined by the reserve ratio (i.e. reserve requirement) that is set by the Federal Reserve. This allows the bank to loan out the remainder of the deposit to borrowers. By loaning out this money the bank creates "new" money in the economy. There are several terms involved in the process of fractional reserve banking.

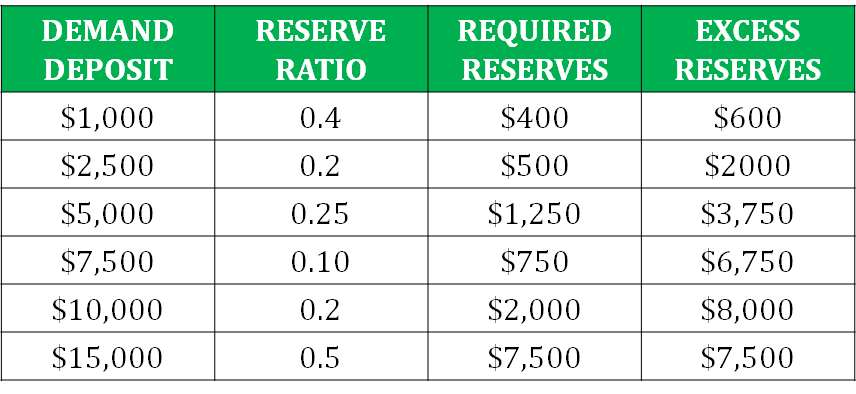

Let's look at how fractional reserve banking operates. In the table below you will see various amounts of demand deposits and a designated reserve ratio. Using that reserve ratio (i.e. reserve requirement), we are able to determine how much needs to be kept in reserves and how much is excess reserves that a bank can loan out.

Money Multiplier

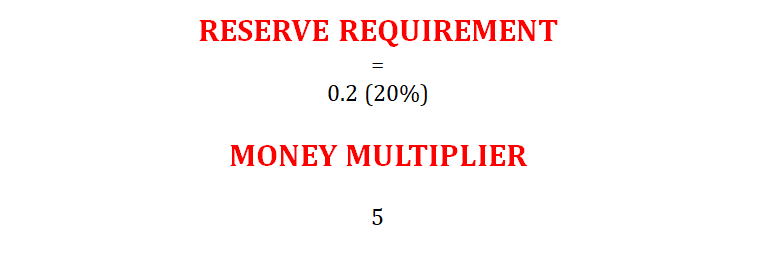

When demand deposits are made, the banks have a portion of excess reserves that are created by the fractional reserve banking system. These excess reserves become new loans and set off a chain reaction of money creation throughout the entire economy. To see how much money is created through this process, we use what is called the money multiplier.

The money multiplier is the amount of money that banks generate with each dollar of excess reserves. The formula for the money multiplier is calculated by dividing the number 1 by the reserve ratio (i.e. reserve requirement).

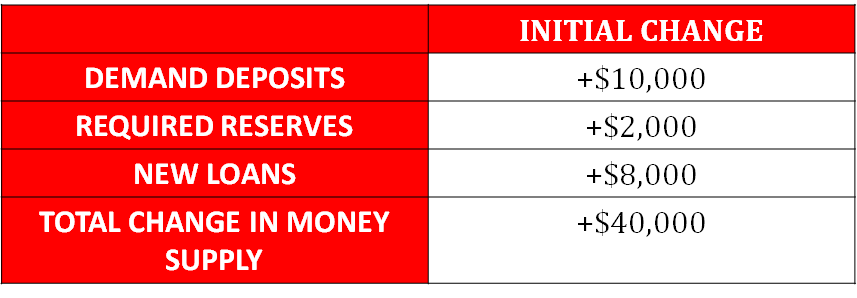

So, if the reserve ratio (i.e. reserve requirement) is 0.2, the money multiplier is 1/0.2, which equals 5. When we take the money multiplier and multiply by the amount of money that goes out through new loans, we are able to determine how much is added to the money supply. So if $8,000 is in excess reserves, the bank loans out all this money, and the money multiplier is 5, we have $40,000 added to the money supply ($8,000 x 5 = $40,000).

If the reserve ratio (i.e. reserve requirement) is higher, the money multiplier is weaker, and there will be less change to the money supply. If the reserve ratio (i.e. reserve requirement) is lower, the money multiplier is stronger, and there will be more change to the money supply.

When we are using this process, there are several concepts we are asked to calculate. Typically, when we are given an amount of a demand deposit, the first thing we calculate is how much of this demand deposit is required reserves, and then we calculate the excess reserves. Once we have the number of excess reserves, we can calculate the change in the money supply.

Let's look at two different examples with the same amount of a demand deposit but different reserve ratios (i.e. reserve requirement).

Example One: For this example, the reserve ratio (i.e. reserve requirement) is 20% or 0.2, which makes the money multiplier 5 (1/0.2).

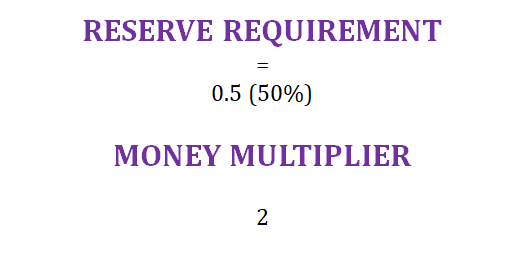

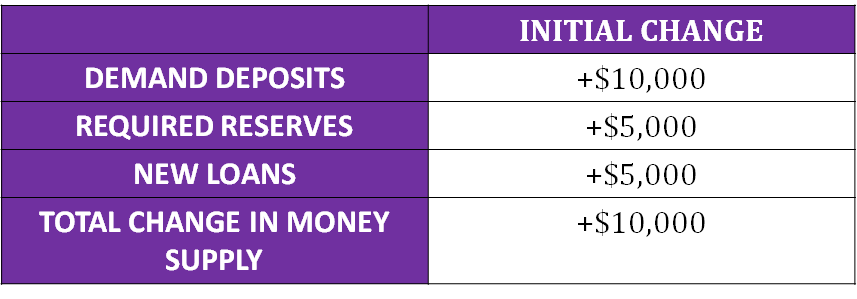

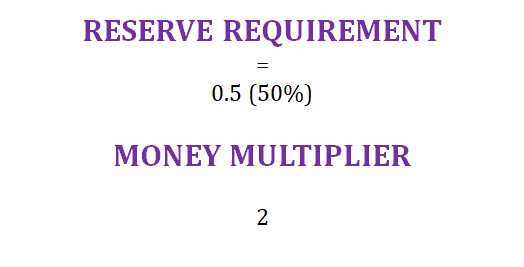

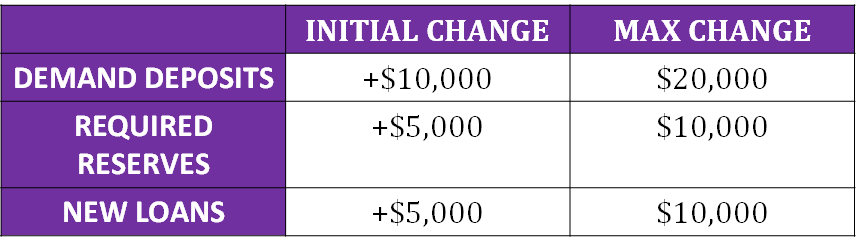

Example Two: For this example, the reserve ratio (i.e. reserve requirement) is 50% or 0.5, which makes the money multiplier 2 (1/0.5).

From these two examples, we can see that the money supply changes more when the reserve ratio (i.e. reserve requirement) is lower than when it is higher.

The money multiplier can also be used to determine the total change in required reserves, new loans, and demand deposits throughout the entire banking system. To find the maximum change in any of these terms, we simply multiply the initial change by the money multiplier. Look at the table below to see some examples using a reserve requirement of 0.5 and a money multiplier of 2.

Bank Balance Sheets

Bank balance sheets (i.e. T-accounts) are a visual record of the fractional reserve banking within a bank. These ledgers show the assets and liabilities within a bank. They can show how a bank uses any deposits and available funds to create reserves and new loans for the purpose of lending. They are called bank balance sheets because the liabilities and assets must be equal to each other.

In the banking industry, liabilities are the financial obligations that a bank must pay to a consumer, and they must be repaid when requested. Liabilities include demand deposits, account investments, and equity. Assets are the possessions that are owned by or credited to a bank that can be collected or liquefied

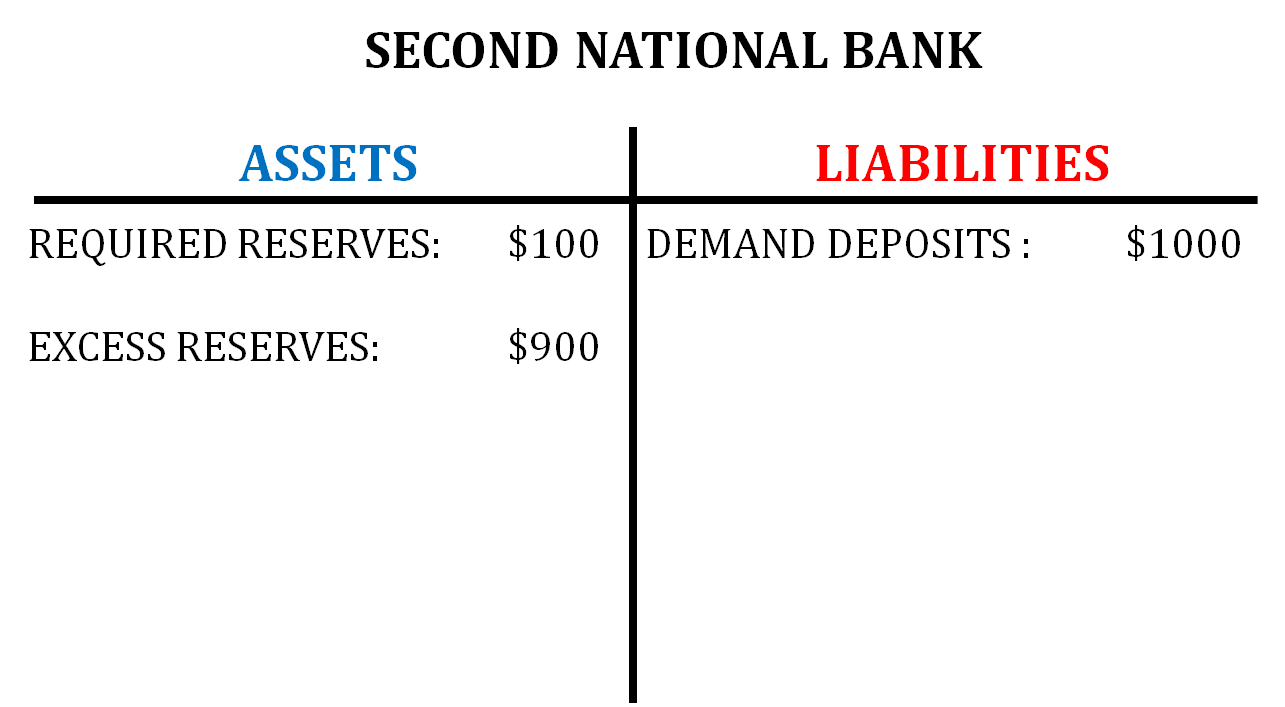

into cash. Assets include both required and excess reserves, outstanding loans, and securities.Here is a sample bank balance sheet for the Second National Bank that has a reserve ratio of 10% or 0.1. This means that the money multiplier will be 10. We are going to assume that they will loan out all of their excess reserves.

You can see that this particular bank received a demand deposit of $1000, so 10% of that deposit has to be kept as required reserves. In this case, the required reserves are $100. That leaves $900 of the demand deposit that is considered excess reserves and can be loaned out. Since we said that the bank will loan out all of their excess reserves, we know that $900 will go out into the money supply and will create a maximum change in the money supply of $9,000 ($900 x 10).

Practice Free Response Question (FRQ) - 2016 # 2

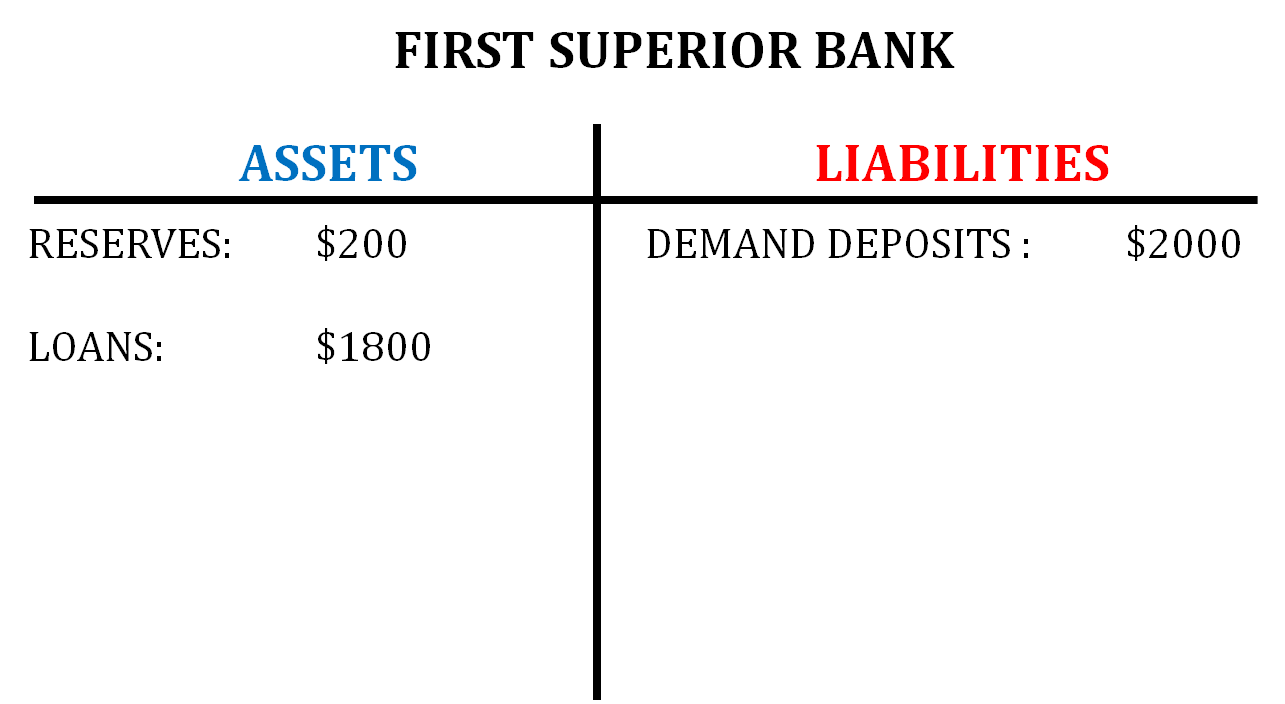

The bank balance sheet above is for the First Superior Bank.

Assume that the required reserve ratio is 10 percent.

- (a) What is the dollar value of new loans that First Superior Bank can make? Explain.

- (b) Mr. Smith deposits $100 of cash in a demand deposit account in First Superior Bank. Calculate the maximum amount of new loans that First Superior Bank can now make.

(c) As a result of Mr. Smith's $100 cash deposit, calculate the maximum change over time in each of the following in the banking system.

- (i) Loans

- (ii) Demand deposits

- (d) As a result of Mr. Smith's $100 cash deposit, calculate the maximum change over time in the money supply.

- (e) Provide one reason why the actual change in the money supply can be smaller than the maximum change you identified in part (d).

Answers

a)

The amount of new loans is zero because the bank has no excess reserves because the bank has loaned all the excess reserves out.

b) The maximum amount of new loans that can be made are $90 ($10 will be the required reserves because that is 10% of 100 and $90 will go into excess reserves and be loaned out)

c)

i. The maximum change over time in loans in the banking system is $900 ($90 x 10 (which is the money multiplier))

ii. The maximum change over time in demand deposits in the banking system is $1000 ($100 x 10 (which is the money multiplier))

d) The maximum change over time in the money supply is $900 ($90 x 10)

e) the money supply can be smaller than the maximum change identified in part d when the public holds more money and/or banks hold more excess reserves.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

📝Exam Skills: MCQ/FRQ

© 2023 Fiveable Inc. All rights reserved.